What Is Assets And Liabilities? What Are The Top 10 Stocks To Buy? What Is Cryptocurrency Trading?

The Confusion About Assets & Liabilities

There’s always been confusion over the years when it comes to the definition of an asset and a liability.

What is assets and liabilities? An asset can help make you money and liability can drain your bank account. Some people think an asset is the most expensive thing someone owns, while others believe that an asset needs to earn you money for it to be called as such. In this article, we’ll break down the asset definition by describing what is an asset. We’ll also share some examples of assets and types of assets, and we’ll teach you how to acquire assets without money.

What Is An Asset?

According to Investopedia:

“An asset is anything of value or a resource of value that can be converted into cash. Individuals, companies, and governments own assets. For a company, an asset might generate revenue, or a company might benefit in some way from owning or using the asset.”

Investopedia

As per Wikipedia:

“In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetary value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business.

Assets can be grouped into two major classes: tangible assets and intangible assets. Tangible assets contain various subclasses, including current assets and fixed assets. Current assets include inventory, accounts receivable, while fixed assets include buildings and equipment. Intangible assets are nonphysical resources and rights that have value to the firm because they give the firm an advantage in the marketplace. Intangible assets include goodwill, copyrights, trademarks, patents, computer programs, and financial assets, including financial investments, bonds and stocks.”

Wikipedia

What Can Be Called An Asset?

- An asset is something containing economic value and/or future benefit.

- An asset can often generate cash flows in the future, such as a piece of machinery, a financial security, or a patent.

- Personal assets may include a house, car, investments, artwork, or home goods.

- For corporations, assets are listed on the balance sheet and netted against liabilities and equity.

An asset is something that a person or a business owns that has a long-term economic value, or in other words, makes you money or appreciates in value.

Historically, many have considered their house an asset. This belief came into place because it’s regarded as the most expensive thing that the average person owns. However, the reality is that most people don’t fully own their homes. Instead, they’re locked into a 30-year mortgage with interest tacked on. And yes, I’m one of these people locked in a mortgage too. While a house can be an asset, the mortgage on the home is what makes this a liability instead.

For a house to be an asset, you would need to have a renter pay down the mortgage. In this case, the renter is paying down the liability. You may also make an extra $100 or so a month, which can be considered passive income. Thus, this strategy of renting out your property can turn a liability, which costs you money, such as a mortgage, into an asset.

What Is The Secret To Building Wealth?

There’s Got to be a Secret!

If it was easy, everyone would be rich. But they aren’t. Well then, what is the secret behind being rich? What does it really really take to be rich?

The secret to building wealth is simple:

Gain Assets and Lose Liabilities

The first time this became clear to me was when I read the book Rich Dad Poor Dad by Robert Kiyosaki. The book is an easy read, though it also has many flaws. If you haven’t read it yet, I encourage you to get a copy and give it a quick read. However, you need to take the book with a grain of salt and don’t blindly follow it 100%. You’ll have to separate the good advice from the bad.

But in all, the book is a life changer!

The biggest takeaway from Rich Dad Poor Dad is how to differentiate between assets and liabilities. It turns out, I had it wrong for years. Once I learned that lesson, building wealth became much smoother. It makes a lot more sense to accumulate assets and avoid liabilities.

There are many problems with Rich Dad Poor Dad. Mr. Kiyosaki is a great motivational speaker and salesman. That’s how he has made his fortune. His books are designed to sell more books, courses, and seminars. Don’t fall for the seminars! They are expensive and not very useful. You can learn a lot more for free on the internet and the library. I recommend reading The Millionaire Next Door and Your Money Or Your Life after you read Rich Dad Poor Dad.

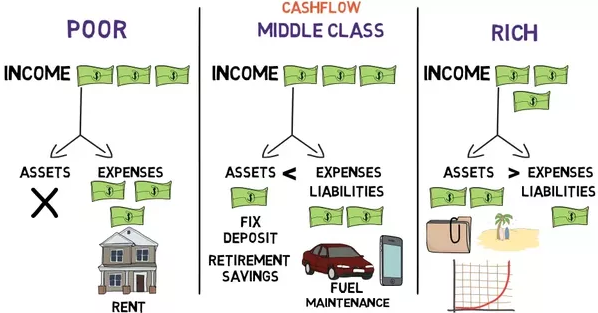

Assets and Liabilities

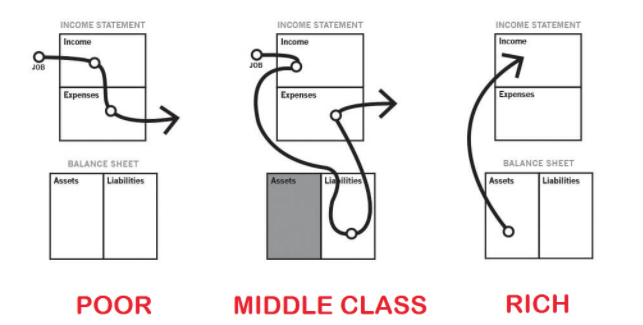

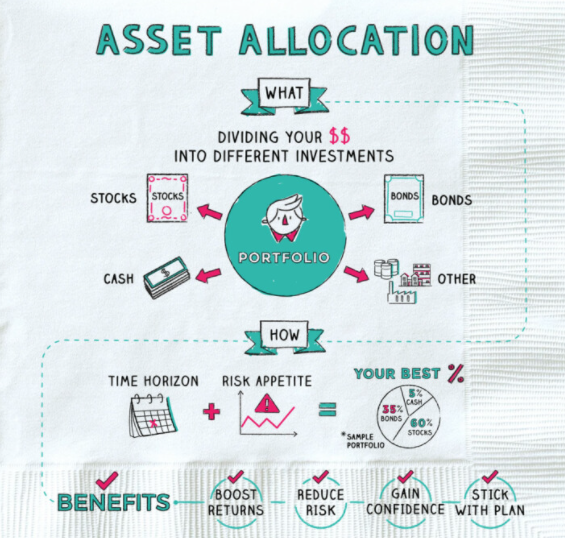

Like most people, I used to think assets mean anything that has a cash value. However, that’s not the right way to look at it. If you want to become wealthy, you need to think of your household finance as a business. An asset is something that, in the future, can generate cash flow for you. Assets make money. Anything that takes money out of your pocket is a liability.

This was a revelation to me. I used to include our home, car, piano, and other personal belonging in the asset column. That’s the wrong way to look at it. All these things are liabilities. It changes how I think about spending. In my 40s, I felt great when I purchased a BMW because I thought it was an asset. Now I know it’s a liability. That’s why I’ll never buy another luxury car as long as I’m building wealth. Once you think about assets and liabilities this way, it is much easier to build passive income.

Let’s Look at it Another Way

- Good assets– Income producing assets such as stocks, rental properties, real estate crowdfunding projects, bonds, and a business.

- Neutral assets – Appreciating assets such as your home, gold, artwork, antiques, and collectibles. I think these are neutral because you never know if the appreciation will beat inflation and the cost of upkeep.

- Liabilities– Depreciating assets like your TV, furniture, and other personal properties. These things are just sitting around leaking money.

- Worse Liabilities– Income consuming assets like your boat, car, and cell phone. These things need a monthly cash infusion to stay functional.

Of course, most of us need our car and cell phone to function in the 21st century. It’s okay to have more liabilities than good assets when you’re starting out. That’s normal, but you need to accumulate good assets to become wealthy.

Where Are You on This Wealth Scale?

This is a wealth scale I invented. It’s a bit different than how we normally think about wealth. We usually think wealthy people live in a big house, drive a luxury car, and belong to an exclusive country club. However, are you really wealthy if you spend all your income every month? Wealth isn’t how much you spend; it is how much you keep.

- Novice/Poor – You’re poor if you have a lot of liabilities and need to keep working to maintain your lifestyle. People can be poor even if they have great income. Unfortunately, most Americans are stuck here most of their lives.

- Amateur – You have been investing for a while and own some good assets. If the value of your good assets is more than 50% of your net worth, then you’re firmly in this class.

- Financial Independence – This should be the goal for everyone. Once the income from good assets, aka passive income, surpasses your expense, you can retire and live life the way you want.

- Generational Wealth – This is beyond financial independence. You have plenty of income from your investment to keep reinvesting. This way your wealth will keep growing and you can pass it on to the kids. That’s generational wealth.

Let’s Finally Define Assets & Liabilities

An asset is something that puts money in your pocket.

A liability is something that takes money out of your pocket.

Before We Go Any Further…

In case you don’t want to read the whole long article, and want a quick custom solution, you could check out some great options below:

Build An Online Business

Check out my reviews of Wealthy Affiliate by clicking below:

Cryptocurrency Trading

You can sign up for CoinDCX Cryptocurrency Exchange below:

If you wish to join the largest exchange in the world, you can sign up on Binance Exchange:

Another popular and reliable exchange is Crypto.com:

Buy Some Stocks

You can sign up for ICICIdirect.com below:

I find Zerodha a really effective site too:

Start Trading In Futures

You can sign up on Zerodha.com below:

Examples of Assets

To break down examples of assets, let’s first separate the list between personal assets and business assets.

Personal Assets

A personal asset is something you own that appreciates in value over time. A few examples of personal assets are:

- Designer clothing

- Sporting equipment

- Artwork

- Jewelry

- A mortgage-free house

- Cash

- Savings account

- Retirement savings plan

- Investment portfolio

- Musical instruments

In some cases, accountants will consider assets as things of value that you own. A few examples of other personal assets may include:

- Cars

- Boats

- Electronics

- Antiques

- Furniture

Business Assets

A business asset is something a business owns that appreciates in value, makes money, or is something you can add to a balance sheet. Here are a few examples of business assets:

- Cash

- Investments

- Brand

- Inventory

- Real Estate (land, buildings)

- Licenses

- Machinery

- Tools

- Furniture

- Fixtures

- Electronics (software and hardware too)

- Automobiles

- Prepaid expenses

- Copyrights

- Patents

Types of Assets

There are five types of assets: tangible assets, intangible assets, financial assets, fixed assets, and current assets. Here’s a brief breakdown of each one.

1. Tangible Assets

Tangible assets are items you physically own such as cash, property, machinery, artwork, or antiques. These items are measurable and are used in people’s or a business’ everyday life. These items have a monetary cap on their value.

2. Intangible Assets

Intangible assets are items that lack a physical presence such as a business’ brand, patents, brand recognition, trademarks, copyrights, or licenses. While these items have a monetary value, it’s harder to measure than something more tangible. It can play a role in measuring a business’s valuation but they aren’t liquid.

3. Financial Assets

Financial assets are assets that are liquid and based on contracts. Examples include cash, stocks, dividends, bonds, derivatives, mutual funds, or bank deposits. They don’t have a physical form but possess a monetary value.

4. Fixed Assets

Fixed assets are measurable assets that aren’t easily converted into cash. For example, land, houses, equipment, and buildings.

5. Current Assets

Current assets are assets that are expected to become cash within a year such as businesses being sold, stocks, product inventory, and liquid assets.

5 Best Income-Generating Assets

1. Websites

If you’re looking to acquire assets, buying a website can be a great investment. Here on Exchange, you can buy and sell e-commerce websites. Some websites include assets mentioned on this list, such as inventory that you can sell for a profit. You can browse the collection of websites for sale and find the one best suited for your lifestyle and skillset. You’ll find everything from drop shipping websites to print-on-demand businesses to subscription box businesses and then some. If you’ve always wanted to start an online business, investing in e-commerce websites can be a fun way to build your asset that’ll make you passive income.

2. Stocks & Cryptocurrencies

Dividend-paying stocks can also be a great income-generating asset that you can own. The benefit here is that you can keep your stocks in the market as they continue appreciating in value but still earn some income through the dividends. Investing in stocks can be a bit risky as there are market crashes every few years. Sometimes there are multiple stock market crashes within the same week as we’ve seen recently. However, you only lose money if you withdraw stocks when the price drops.

Some investors recommend reading annual reports from the businesses you invest in from the last page to the first page, to help you determine whether or not the stock is a buy or a sell as the beginning is always filled with the positive aspects of a business.

What is cryptocurrencies? Well, these are digital currencies that have huge value today because they are so popular. These can also be held for price increase, or traded like stocks.

3. Rental Properties

Rental properties can be a great asset to own. Keep in mind that house prices don’t always go up in value, so you’ll want to work with a real estate agent to help you find the best investment properties. With a rental property, you only need enough to pay for a down payment to purchase the property. After that, a tenant pays down the property as he or she will be living in it.

Some landlords make at an extra hundred dollars or so a month that can be reinvested into the property or saved as a source of income. Some real estate investors choose to buy multiple properties to help elevate their earnings. Keep in mind that this strategy isn’t effective everywhere, as real estate, can be expensive in certain cities or not a viable option in others. Remember to work with an industry expert to help you find the best deal to build real estate assets.

4. Savings Account

If you’re interested in building an asset, however, are currently starting from zero, you may choose to start with a savings account. Your savings account can become an asset as it’s a clear example of money making money. Every time you make money put as little as ten percent of your earnings into a savings account. Do your research as some accounts may have better interest rates than others. For example, in Canada, the Tax-Free Savings Account allows you to earn money from capital gains and interest without being taxed on it. Shop around to find the best interest rates or financial benefits for savings accounts.

5. Businesses

Businesses can be great income-generating assets as well. If you run an online store, your business might have assets as well. For example, the inventory you own is an income-generating asset. And your business and brand are assets too. With your business, you can sell physical or digital products or even services to earn additional income. By growing your business’ authority online, you can create something that appreciates in value over time. And when you’re ready to retire or work on something new, you can sell your business to someone else.

6. Precious Metals

Buying and holding precious metals like gold, silver, platinum, etc can be a great investment in the long run. Check out my article on Regal Assets Wealth Partners (RA Wealth) to learn a bit more about companies that offer premium services for such ventures.

How to Acquire Assets When You Have No Money

With many people struggling financially right now, you might be thinking to yourself, “I don’t have money to acquire an asset.” But even in the toughest economic times, there’s always a way to acquire assets when you have no money. So, we’re going to share a few ideas on how you can do that. Let’s first look at what’s the easiest way to make money online?

1. Build An Online Store

Shopify is the platform where you can create your online store. You can access free themes, stock photos, and courses too.

Now, you might be thinking to yourself, “Well, that’s great. But I can’t afford to buy product inventory.” Well, fortunately, Shopify owns a brand called Oberlo that allows you to find products and sell them without buying inventory. It’s a process known as dropshipping. And they have a forever free account that will enable you to add products to your store without paying for a monthly subscription.

Then, over the next few months, you’ll need to focus on free marketing strategies to help you generate sales. The most effective strategy is content creation. You can create videos for social media about the product. You could create social media posts. Blog posts are one of the most effective long term strategies too. You can write SEO-optimized blog posts about your niche, or in other words, industry, and post links to the blog post on Pinterest to help you get traffic to the article for free. The more content you produce, the more likely that you’ll grow your organic traffic. Thus, increasing your website’s value.

You can also build a blogging website on WordPress. Blogging websites are a great resource and a very easy way to earn affiliate commissions.

2. Trade Assets

Many people own something of value. Maybe you have an expensive piece of jewelry you never wear, own a rare guitar that’s collecting dust in your storage, or have an Airbnb rental property that’s currently empty.

You could trade these assets for something of appreciating value. If you know someone who has an asset that you’d like to own, you can offer them an asset you own in a trade deal. You can negotiate with people who are selling something of appreciating value.

Or you can sell these assets to help you stay afloat during this difficult time. However, if you do earn money, aim to save at least half of what you make to invest in another asset so you can still own things of economic value or appreciating value.

3. Buy Assets With Assets

In Rich Dad Poor Dad, Robert Kiyosaki shares his strategy for how he buys assets with assets – in some cases, without using his own money. In one scenario, he asked a friend to loan him $2,000 and offered to pay $200 of interest so he could buy a property. He purchased the property for $20,000 at a bankruptcy attorney’s office.

Since the home was actually valued at $75,000, he decided to set a price of $60,000 to entice bidders. When he sold the house, he asked for a $2,500 processing fee, which the buyers paid for and was able to pay the loan with interest to his friend without using his own money. The house sold for $60,000, which net him a $40,000 profit. And he did it without using his own money.

Best Investment Options in India

1. Equity Mutual Funds

An equity mutual fund is one that uses the pooled corpus to invest in equity and equity-related instruments.

A major portion (65% and above) of the portfolio holdings are in the form of shares and stocks of different companies. In other words, equity mutual fund invests in shares on your behalf.

A small portion of the portfolio is invested in debt and money market instruments or held in cash.

The investment objective of equity mutual funds is capital appreciation. The fund achieves its objective by investing in growing or mature businesses that have the potential to generate multi-fold returns.

Benefits of Investing in Equity Mutual Funds

Equity mutual funds generate returns based on the growth potential of businesses. As companies grow in revenues and earnings their share price also increases which leads to the capital appreciation of the equity portfolio.

The capital appreciation helps investors create a wealth corpus in the long run. The corpus can be used for fulfilling life goals like retirement funds and children’s education & marriage expenses.

Equity mutual fund schemes hold a portfolio of multiple stocks to reap the benefits of diversification. In comparison to direct equity investment, when you invest in equity mutual funds you have the benefit of diversification.

Equity Mutual Funds are best for

Returns from equity mutual funds are volatile and depend on the market sentiments/ fluctuations, company performance, and economic factors.

That makes equity mutual fund investment best for long term investors who are looking to grow their wealth over the long term.

Further over a long period market fluctuations get leveled out. In fact, a period of over 10 years is best to reap an inflation-beating growth rate from equity investments.

2. ELSS

“Equity-linked saving scheme” popularly known as ELSS is a mutual fund scheme that helps you save taxes.

When you invest in an ELSS, the investment amount up to Rs. 1.5 Lakhs qualifies for a tax deduction under section 80C of the Income Tax Act.

So overall, you can avail a tax benefit up to Rs. 46,800 by investing up to Rs. 1.5 Lakhs in ELSS funds.

Benefits of Investing in ELSS

When compared to traditional 5-year tax-saving FDs, ELSS is a better option for tax planning. The investments offer the lowest lock-in period and higher returns when compared to other tax saving options like NPS, PPF, and tax-saving FDs.

ELSS has a three year lock-in period which is lower than the 15 year lock-in period of PPF and 5 years of lock-in in case of tax-saving FD.

Tax saving mutual funds have the potential to generate inflation-beating growth rates of 12% or higher over the long run. This is higher than the 8% returns offered by PPF and NSC. High returns from ELSS is possible because of the underlying investment in equity assets.

ELSS is best for

Tax saving mutual funds are best for investors looking for a prudent tax planning and tax-saving methods. Apart from that, ELSS funds can be the entry point to the universe of mutual fund investment.

3. Debt Funds and Liquid Funds

Debt funds are mutual fund schemes that invest a major portion of the pooled corpus of money in fixed-income or money market instruments like corporate bonds, debentures, government securities, treasury bills, commercial papers, and certificates of deposits.

Debt funds generate returns in the form of interest income and maturity proceeds of the underlying debt securities.

The fixed-income securities provide a stable and regular stream of cash flow without the risk of market fluctuations. Thus, debt funds offer a safe investment option for conservative investors.

A liquid fund is a mutual fund scheme where the major portion of the pooled corpus is invested in securities that have a specific maturity of up to 91 days only. This is to ensure that the fund remains highly liquid all the time.

Liquid funds aim to create a highly liquid corpus for the investors.

The underlying securities are highly rated safe debt and money market instruments like Government securities, T-Bills, Call money, Commercial paper (CPs), and the Certificate of deposits (CDs).

Benefits of Investing in Debt Funds and Liquid Funds

Debt funds are less volatile compared to equity mutual funds. Thus, investors having lower-risk appetite benefit by investing in the debt funds.

In FDs, the interest income is taxed each year whereas the debt funds are taxed when you redeem. Thus, debt funds are more tax-efficient than traditional investment options like fixed deposits.

Benefits of Investing in Liquid Fund

Safety and liquidity are the hallmarks of liquid funds. They offer one of the safest investment options. The underlying short-term debt and money market instruments carry the least risk. The safety comes from the fact that the corpus is invested in the highest credit quality and short-term instruments.

Apart from that, liquid funds provide a higher return in the range of 6% to 7.5% as compared to the savings bank account.

Debt funds are best for

Debt funds have a lower risk because they are not subject to wide market volatility. This makes them safer avenues for conservative investors.

Debt funds are better suited for financial goals like buying a car, repayment of a loan or vacation expenses. Hence, debt funds are best for investors looking to fulfill short to medium-term financial needs.

Liquid Funds are best for

Liquid funds are best for investors with surplus cash and short-term investment horizon. It helps investors park money until the investment avenue gets finalized.

Apart from that, you can use liquid funds for creating an emergency fund. The fund can be used in case of a medical emergency or job loss.

Liquid funds can also be used for creating provisions. For example, you can make provisions for paying insurance installments, school fees, and rent payments.

4. Gold

In India, gold is a popular traditional investment option, especially in the form of gold jewelry and ornaments. Their demand goes high during the wedding seasons.

Gold has an inverse relation with the share markets. Generally, when the stock markets are down the gold tends to perform well.

If you do not want to hold gold jewelry then you can invest in gold through “Gold Funds” a “Gold ETF”.

5. Public Provident Fund (PPF)

Public Provident Fund is a government-backed retirement scheme that also helps you save taxes. So you have the dual benefit of creating retirement fund and tax saving.

Annual contribution up to Rs. 1.5 Lakhs in PPF account can be claimed as a deduction under section 80C of the Income Tax Act.

A PPF account can be easily opened at post offices and banks. In the case of PPF investment the interest earned and the maturity proceeds both are exempted from Income Tax. However, PPF investment has a long lock-in period of 15 years.

6. Shares

For investing in shares you need to open a Demat and trading account. Investing in stocks is buying ownership in a company and its growth prospects.

If done correctly, shares have the potential to generate multi-fold returns over a long period of time. For that to happen you need knowledge, experience and dedicated time to monitor your stock investments.

However, share investments are risky because they are subject to market fluctuations, company performance, and economic factors.

7. National Pension Scheme (NPS)

National Pension Scheme is a retirement plan for all salaried persons. A regular contribution from both employee and employer is invested in the NPS account.

NPS differs from PPF by investing a portion of the fund in equities to capture higher returns.

When you invest in NPS, then the investment amount up to Rs. 1.5 Lakhs is eligible for tax deduction under section 80C of the Income Tax Act. Additionally, the self contribution of up to Rs. 50,000 of tax benefit can be claimed under section 80CCD(1B). So overall, you can save up to Rs. 2 Lakhs annually in taxes.

However, NPS has a long lock-in period until retirement. Post-retirement, you will only withdraw 60% of the corpus and the rest 40% is utilized to purchase annuities.

8. Recurring Deposits

For the purpose of investment banks offer “Recurring deposit or RD”. It is an interest-bearing instrument having a fixed maturity period.

You have the flexibility to choose a regular investment amount that can be as low as Rs. 10. The investment period can be a minimum of six months to a maximum of 10 years. You need to make a regular monthly investment of a fixed chosen amount.

Returns from RD are taxable and there is a premature penalty in case of early withdrawal.

9. Fixed Deposits

Fixed deposits are also known as “Term Deposits” or FDs. In FD, an upfront lump-sum investment is made for a fixed tenure at a fixed rate of interest. The FD interest rate varies from bank to bank.

“5-year tax-saving FDs” helps you save up to Rs. 1.5 Lakh on taxes under section 80C of the Income Tax Act. The lock-in period for such a fixed deposit is 5 years.

However, the interest income is taxable and banks do not allow you to pledge the 5-year tax-saving FDs. Other term deposits can be pledged for availing loans.

10. Real Estate

Investment in land, building, and property is termed as a real estate investment. You get returns in the form of capital appreciation and regular cash flows in the form of rental income.

For that to happen, you need to make sure that the location of your property is at a prime location and you have good tenants.

However, real estate investment requires a huge sum of investment upfront. Additionally, you need to yearly pay municipal & property taxes and incur expenses on maintenance of the property.

To Sum Up This Section

Let me just say that the above investments mainly fall under the classification of conservative. Low risk, low yield!

It’s not that I do not believe in guaranteed returns. But planning for an annual return of 8% on your investment is a bit on the low side these days, don’t you think?

What I am saying is that the world has moved on to bigger things, and if we do not get out of our conservative mindsets, we will stay in the circle of middle-class forever.

Those who think big, also achieve bigger results.

But it is a personal choice for each individual.

My Short List Of Personal Investment Options

Well, I am a bit of a non-conventional investor. For me, Fixed Deposits and Government Bonds that give you 8% annualised returns are a no-go. I just don’t have the patience.

What Works For me

Some of the assets that I invest in are as follows:

- Online Businesses

- Websites

- Cryptocurrencies

- Futures & Options

- Precious Metals

- NFTs

- Stocks of very selected Future Technologies (Hint: Genesis)

- Real Estate

You Have to Figure Out What Works For You

We each have our own perceptions, gained over a lifetime. Put those to good use. You must understand how the minds of the rich, the middle-class and the poor work. This is how Robert Kiyosaki explains it:

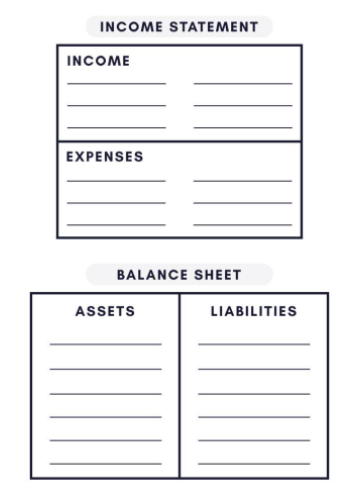

Take a pen and paper, and list out your income, expenditure, assets and liabilities in a format like the one given below:

Next, write down what assets you wish to have. Give a thought based on the following:

Make a list based on what investment instruments you want to invest in, and the amount of money you are willing to put into those instruments.

Now start making those investments. Don’t keep waiting for that day to come. Or that Financial Consultant to advise you. You already know what is to be done. Just go ahead.

Start Creating Assets

Now that you know what is an asset and how to create ones that’ll make you money, you can start off to build out your own. Owning something that’ll appreciate in value over time or will make you money is a great way to create financial stability in an unstable world. With so much economic uncertainty in today’s world, there’s never been a better time to start building an asset of your own.

Financial investment doesn’t always start big. In most cases, people start with a couple of hundred dollars and reinvest the money until it becomes greater than they ever could have imagined. Whether you start with a savings account, your first online store, or by buying stocks when priced low, you’re on the right track to building an asset that’ll help protect you financially in the long run.

Which type of assets are you looking to build today?

What Assets Can You Start With?

If you are looking for a specific action plan, this is it.

Let’s say you have a total of $10,000 with you at present, which you think you can employ for creating further assets. What can we do with this money to start building assets for you, and increasing the value of this money?

We could divide this money as follows:

| Asset To Invest In | Amount Of Investment | Percentage of Total Money | Other Details |

|---|---|---|---|

| Set Up An Affiliate Marketing & Blogging Website | $500 | 5% | On Wealthy Affiliate |

| Invest in Cryptocurrencies | $3000 | 30% | On Binance Exchange, CoinDCX Exchange, or Crypto.com Exchange |

| Buy some Stocks | $2000 | 20% | On ICICIdirect.com |

| Start Trading in Futures | $2000 | 20% | On Zerodha |

| Emergency Money | $2500 | 25% | In Your Bank |

This is a list of options that are easy to start with. other options include NFTs and Art Works and Real Estate, all of which take time and can be a bit complicated, depending on where you live.

Let us now look at the specific options in the table above, in detail. Show me the money!

You Can Invest in Learning a Skill That Has Value Online

Affiliate Marketing

A very good place to start is to invest in an online business. The biggest advantage here is that the cost of starting is almost nothing. Remember, money is made by learning skills that have value in the online world. One such skill is running an affiliate marketing & blogging website.

Affiliate Marketing is the simplest online business model. And the cheapest as well.

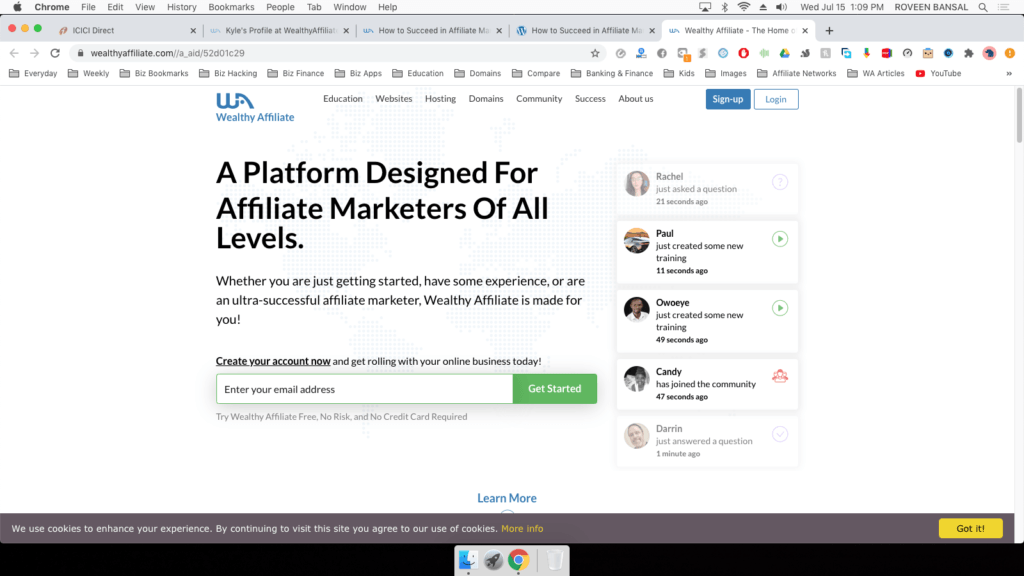

Wealthy Affiliate

Wealthy Affiliate is a platform that teaches you step-by-step how to start a website and set up an affiliate marketing business from scratch. No prior experience is needed. It is a one-stop-destination for setting up your website and learning how to run it, while all the necessary resources are provided by the platform. Basically what that means is that if you sign up for Wealthy Affiliate, that is all you need to do. No other training required. No other skills required. They will teach you all that you need to know, in the most systematic way possible. I myself started with Wealthy Affiliate a few years ago.

It costs only $49 per month to become a member. That’s $600, or just about $500 if you pay for the annual membership.

And you can try it for FREE. No tricks whatsoever. You don’t even need a credit card or debit card. All you need is an email address.

Join, and try the platform for FREE for 7 days. If you like it stick on. If you don’t like it, we will say bye-bye.

If you like it, I can offer you an additional month at only $19 to further check-out the program to see if it works for you. If it doesn’t, you go your way, and I go mine.

If you like it, and wish to stay on, you get to join this unbelievable community of over 1.5 million people, all working towards a common objective, at just $49 per month.

And, there is a way to earn back even those $49 per month, within the Wealthy Affiliate platform, which I will teach you. You see, I shall be your mentor all along. And trust me, you cannot manage in today’s online environment without a mentor, if of course, you want to make some serious money ahead.

There are only a few programs like Wealthy Affiliate on the internet that are genuine, but you can know for sure, only after you have used them. It’s FREE to join up, and you get a whole 7 days to see if it works for you. So you have absolutely nothing to lose. They don’t even want your credit card details.

Taking action is what counts. Only that can change your life.

Believe me, the small amount of money you spend on Wealthy Affiliate, if you plan to buy their Premium program later, is nothing compared to the life-changing opportunity and education that you are going to get. You only need to recognize it, today.

If you feel that spending $49 a month, or $500 at one go is a lot, then you should join for FREE, and check it out. I was hooked totally after the first week. But we are all different. So see if it works for you.

And if you promise not to tell anybody, I can teach you how to make back those $49 that you paid as monthly fees, within the Wealthy Affiliate program itself. I do it every month. You can too. Within Wealthy Affiliate, people buy credits that they use to get other members to write “comments” for them on their articles. Wealthy affiliate allows you to earn this money by writing comments for other members. So you can make your paid-membership totally free as I have done.

Yes, Wealthy Affiliate is totally FREE. They give you time to understand the Premium level of the program fully for 7 days, without spending anything. In addition, you get a website free along with hosting, security, SSL and other benefits. Even after the 7 days free Premium trial is over, you can continue building the free website.

If you wish to upgrade to Premium later, you can do that as it obviously gives better tools & functionality within the platform. Or you can continue to learn and build your website, without paying anything at all.

Check out my reviews of Wealthy Affiliate by clicking below:

There are thousands of other Affiliate Marketing Programs that you can choose from. However, Wealthy Affiliate is, by far, the best. Do take a look below too.

Stop For a Moment…

My Aim

My aim is also to review important internet marketing courses & resources of value.

I have lately reviewed some of these training programs, tools & resources online, and here’s a summary of the top few, in the order in which I rate them:

| Program | Type | Owner | Rating |

|---|---|---|---|

| Wealthy Affiliate | Affiliate Marketing & Website Development | Kyle & Carson | 9.9/10 |

| Authority Hacker (TASS) | Affiliate Marketing | Gael Breton | 9.5/10 |

| Income School 24 | Niche Websites | Jim & Ricky | 9.3/10 |

| Designrr | Ebook Software | Paul Bannister | 9.0/10 |

| Sqribble | EBook Software | Adeel Chowdhry | 9.0/10 |

| Speechelo | Text To Speech Software | Stoica Mihai | 9.0/10 |

| Jaaxy | Keyword Research Tool | Kyle & Carson | 8.8/10 |

| RA Wealth Partners | Financial Marketing | Tyler Gallagher | 8.7/10 |

| 2020 Super Bundle | Affiliate Marketing | Brendan Mace | 8.6/10 |

| Partnership To Success | Affiliate Marketing | John Thornhill | 8.4/10 |

| Rich Dad Summit | Online Seminars | Robert Kiyosaki | 8.2/10 |

| 12 Minute Affiliate System | Affiliate Marketing | Devon Brown | 8.1/10 |

| Legendary Marketer | Affiliate Marketing | David Sharpe | 8.0/10 |

| $1K A Day Fast Track | Affiliate Marketing | Merlin Holmes | 7.8/10 |

| Perpetual Income 365 | Affiliate Marketing | Shawn Josiah | 7.6/10 |

| Click Wealth System | Email Marketing | Matthew Tang | 7.5/10 |

| Salehoo | Dropshipping | Simon Slade & Mark Ling | 7.4/10 |

| Live Marketing HQ | Affiliate Marketing | Justin Atlan | 7.2/10 |

| Commission Hero | Affiliate Marketing | Robby Blanchard | 7.1/10 |

| Wolves Academy | Affiliate Marketing | Eric Ellis | 7.0/10 |

| Videly | Affiliate Marketing | Stoica & Vlad | 6.9/10 |

| Video Creatox | YouTube Marketing | Marc Christiansen | 6.6/10 |

| Elite Traffic Pro 2.0 | Email Lists | Igor Kheifets | 6.3/10 |

| Super Affiliate System | Affiliate Marketing | John Crestani | 6.0/10 |

| Magic Submitter | Affiliate Marketing | Alexander Krulik | 5.6/10 |

| CashBlurbs | Traffic Leads | Bryan Winters | 5.3/10 |

| Empire Free Traffic System | Traffic Leads | Fergal Downes | 5.2/10 |

| Udemy Courses | Online Courses | Gagan Biyani | 5.0/10 |

| Diddly Pay Pro | Free Traffic Generator | Bryan Winters | 4.7/10 |

| Recession Profit Secrets | Affiliate Marketing | Richard Pierce | 4.5/10 |

| Clickbank University | Online Courses | Eileen Barber | 3.5/10 |

| PayingSocialMediaJobs.com | Social Media Managing | Annie Jones | 3.0/10 |

| Millionaire Society | Turnkey Internet Businesses | Mack Michaels | 2.7/10 |

| PaidOnlineWritingJobs.com | Freelance Writing Jobs | Not Known | 2.4/10 |

| Swift | Free Traffic Generator | Venkata Ramana | 2.0/10 |

Would You Like To Hear from Us?

Let’s Come Up With a Win Win Situation

Would you like to be an ‘author’ with www.make-cash-online.com? We are always on the lookout for top-notch writers, who want to be a part of us. We only accept quality blogs & reviews. And we pay between $10 & $15 for each article. For more information please click here.

Invest In Cryptocurrencies

Why Are Cryptocurrencies Considered Risky?

The time when cryptocurrencies were considered unreliable and volatile are over. Cryptocurrency prices may fluctuate a lot, but that can easily be exploited to your benefit. Today cryptos are the investment options for the richest individuals, corporations, banks, and governments.

Crypto currency prices are rising each month, and now is the time to invest. Cryptocurrency trading can actually be quite lucrative. What is cryptocurrency trading? It’s just like trading in stocks and securities, except that the stakes are higher. It’s an easy way to earn money online.

There’s not much to discuss actually. You can either buy cryptocurrency now, or you can do it after 5 years when everyone will be investing in them, in any case. If you wish to catch them at a time when there is still money to be made, that time in now in 2021.

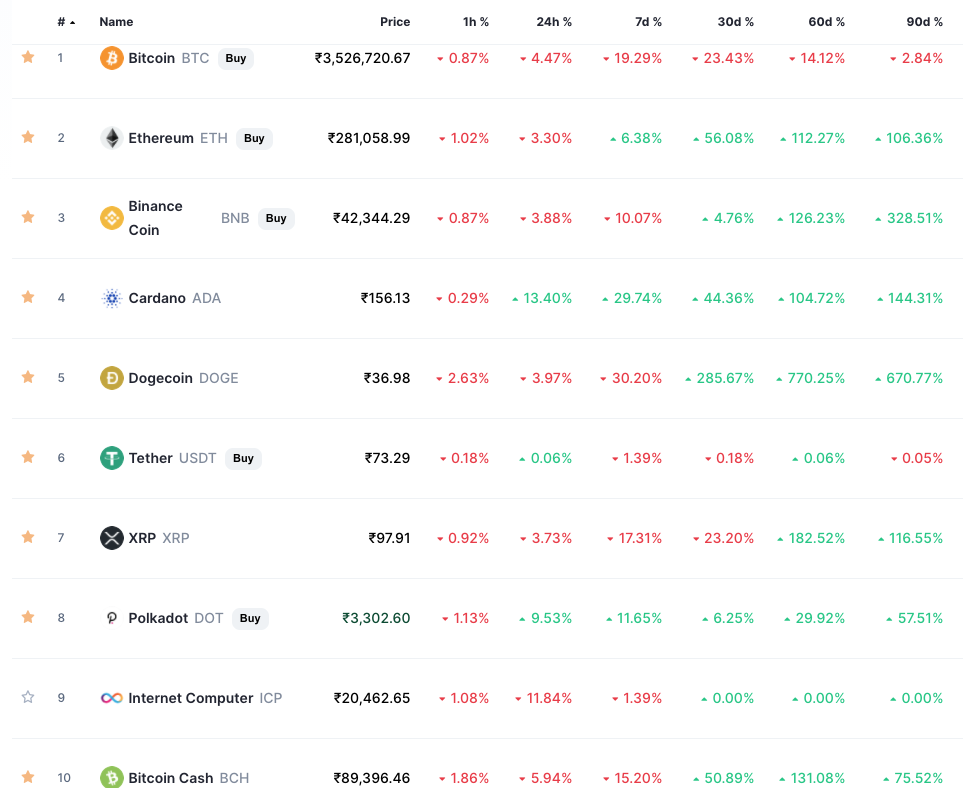

Take a look at a cryptocurrency list of the top 10 cryptos by market capitalization on CoinMarketCap.com:

Top 10 Stocks to Buy

As an example, purely for investment purposes, the top 5 cryptocurrencies 2021 could be:

- Polygon Matic

- Ethereum

- DogeCoin

- Binance Coin

- Cardano

But your list could be different from mine, as we have diverse objectives and aspirations.

What is Cryptocurrency Exchange For?

What is cryptocurrency exchange for? Cryptos are traded today on hundreds of Exchanges, very much like stocks and securities. You can also do cryptocurrency mining, which is a method of generating cryptos using your computer. Mining cryptocurrency consumes a lot of electrical power, and that is the cost that has to be taken into account while mining.

What is cryptocurrency scam? Well, if you deal through Ponzi schemes or unknown websites which promise quick and huge returns, then you can become part of a cryptocurrency scam. The best way to avoid these scams is to stick with known cryptos and popular exchanges, and nothing will go wrong.

What is Cryptocurrency Trading?

Let’s see how do you get started in cryptocurrencies?

Well, you sign up on a website which is basically a Crypto Exchange. The world’s biggest exchange is Binance. A really systematic exchange is CoinDCX, while crypto.com is another reliable one.

You can sign up for CoinDCX Cryptocurrency Exchange below:

If you wish to join the largest exchange in the world, you can sign up on Binance Exchange:

Another popular and reliable exchange is Crypto.com:

Buy Some Stocks

Purchasing stocks of popular companies is another great way to increase your assets. In India, www.icicidirect.com is a great platform for stock investments. Zerodha is another well organized and reliable broker.

Your top 10 stocks to buy may differ from mine, but there is so much growth happening in all economies, that it hardly matters what is the best option. You should just make a start and the rest will figure itself out.

You can sign up for ICICIdirect.com below:

I find Zerodha a really effective site too:

Start Trading In Futures

While you can deal in Stocks with the amount of money you have, you can deal in much larger investments if you deal in Futures. It is similar to stocks, except that only a margin of your investment amount is used.

Futures are derivative financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and set price. A futures contract allows an investor to speculate on the direction of a security, commodity, or financial instrument.

For more details, you can check out Zerodha Varsity.

You can sign up on Zerodha.com below:

Emergency Funds

Make it a habit to always have a stock of emergency funds with you. This is cash that should not be touched unless there is a do or die situation. Only the strictest of self-control can make you stick to your plan. Let this be the starting point of your journey of financial discipline.

Start NOW!

My advice to anyone who wishes to make a start in creating wealth is…

START NOW

Wishing you well in your journey of financial abundance and independence.

If you have any contributions to make, or questions to ask, you can put them down in the comments below. I would love to hear from you.

Thank you for reading. Smile always.

Regards,

30 Comments

Leahrae

Boy after reading this post, I can see that I do not have a lot of assets. But then I knew this. See, I have been a single mom my son’s whole life. There have been lots of struggles and we do without for a variety of things. So it’s a catch 22 for me. I’ve always known what a good asset is, one that I don’t have, but I don’t have the extra cash to invest in anything. So how does someone with no “good” assets, find a way to afford them? You know the saying, it takes money to make money. Viscous cycle for me.

Aps

That’s true Leah, but what is also true is that we wait too long to start investing the right amount. I say you start with just $10 or $50, but start investing. In a short period of time, you will start getting investment income, and that is really awesome.

Alblue

This is a very detailed explanation of assets and liabilities. I’m in process of growing my personal finance knowledge and awareness, so thanks for providing a very thorough explanation. Since assets can be everything that contains economic value/benefit, does that mean entertainment toys such as action figures from Star Wars can be considered as Assets? I heard toys can be sold at a much higher value for collectors. It’s quite confusing since I originally didn’t include it as my asset in my taxation reporting.

Aps

Thanks for reading my article.

Cogito

Hi Ron. Thank you for this great post. I think its most comprehensive and detailed post on earning money I have ever seen. There are so many information there that I don’t know even where to start. But I couldn’t agree more that wealthy affiliate is great investment for all people who want to earn money online. With tons of trainings and supportive community its great starting point for all beginners. And with so many other options you described everyone can find best option to start generating profit online.

Aps

Thank you Cogito

Aly

It’s amazing how those two simple words and concepts of assets and liabilities can become so nuanced so quickly!

I remember finding the concepts of good debt and bad debt a bit curious when I first heard the terms together — so much of what I’d been hearing was that all debt was bad. It’s good to see the big picture and having a better understanding of how it all fits together is key. Thanks for sharing this – I plan to keep the link handy for future reference!

Aps

Glad you found it useful Aly

Bill

Do you think cryptocurrency will stay stable, I’m earning a currency called WESA and it’s, sporting for me to withdraw are do anything because of the exchange rate.

I do agree with you’re content because it sounds like I’m trying to turn in the right direction, due to my 2 websites and I do have an online store also SFI, and Wealthy Affiliate is my online business,

In my opinion, if someone just passed up the opportunity to read your content would be missing out on some very valuable input.

Thank You,

Bill Wright

Aps

Wow! Thank u Bill. I am humbled by your thoughts.

Christine

This was very eye-opening. I think I am in the amateur category and I own some fixed assets, like my land for example.

How can I invest in equity funds? I have been thinking of doing that, investing in something like that to create a passive income. Do you have any tips?

Aps

It’s very easy really, Christine. Just sign up on a website that you trust. And add funds to it from your bank. Then start trading in stocks. One or two YouTube videos and you will be well on your way.

pitin

Wealth is the measure of one’s capacity to live a desired life. It’s relative, subjective, and in constant flux. For some, the best asset you can acquire is your knowledge. It ultimately does not matter much what details are included in your wealth portfolio, because over time, markets and economies will go up and down. What is more important is that you invest in yourself by continuously learning so that no matter which direction the economy takes – up or down – you’ll be a winner. In investing with your own knowledge, you’ll see remarkable increases in profits and resources. 🙂

Aps

Omg! That’s a lovely thought Pitin. Very well said indeed. Investing in yourself by learning new skills will always keep you rich, both monetarily as well as psychologically.

This post is of course aimed at newbies, and those who are just starting with their investment journey.

Thank you Pitin, you Super Woman. I’m honored that you chose to comment on my post. I’m a big fan of yours.

Ivan

Thanks for sharing this post about assets and liabilities. One of the best definitions I’ve heard is from the book “Rich Dad Poor Dad” by Robert Kiyosaki. He said, and I love this, “Assets put money in your pocket. Liabilities take money out of your pocket. Rich people buy assets. Poor people buy liabilities.” We live in a world where we are taught to act like poor people and hope to become rich one day. They should really teach this more in schools and other educational institutions. I’m fascinated by this topic and I like to read about it. Your post here is awesome! It’s extremely insightful and helps me to understand the difference between assets and liabilities even more! Thanks for sharing and keep up the good work.

Aps

Those are really kind words, thank you Ivan. It’s actually a very basic post. I’m glad you appreciate my work.

James

Hey Ron, thanks for this informative article. I’m currently trying to build a business online and it’s taking some time. The stuff you have on your website has really helped me out!

Aps

That’s great James

Ladia

Thanks for this informational post. I learned about assets and liabilities from rich dad poor dad, but this post was definitely something beyond that. I learned a lot through your examples. Thank you.

admin

There are ideas on my website for side hustles that will, at most, earn you and me a few hundred or thousand dollars every month.

I wonder, though, if you are interested in the REAL thing! The actual big-bucks! Affiliate Marketing with Wealthy Affiliate! Do check it out.

Love

Aparna

Toni

I did not put much thought into getting a better understanding about assets before. I can really appreciate this article. Apart from the definition, the break down to show the different types of assets has opened my eyes. I can see this new comprehension about assets helping me with future finances. Thanks.

admin

Thank u Toni

Richard Brennan

Hi Aparna

Like you, I’m a student of Robert Kiyosaki and I was one of those people who regarded a house as an asset until I heard his explanation of why it is, in fact, a liability as you so clearly remind us here.

When you mention cash and savings accounts as assets, it made me wonder how much longer that will be the case?

Already, above interest inflation is eating away at people’s cash inside their savings accounts and their value is declining all the time, unless someone happens to be fortunate enough to have enough spare cash to be able to open a high interest account. Not many people are that lucky.

Assets which are much overlooked are precious metals such as Gold and Silver. Gold has been a ‘store of value’ since it started being used as money around 6000 years ago. Over that time, it has never lost it’s purchasing power. Robert Kiyosaki now highly recommends investing your cash into Gold and Silver to avoid it’s steady and consistent decline in value.

admin

Ah … Rich Dad Poor Dad ! My Guru.

Jason

That’s quite an interesting read, thank you. I considered myself someone who have a reasonable handle on the various asset classes but I guess they were the better known classes i.e. property, managed funds, e-commerce, personal effects, bonds etc. so you’ve definitely broadened my mind. I wasn’t actually aware that you could buy websites. I assume though that you would need to run the website business and further develop it before re-selling it if that was the intention. I wonder how intensive that process might be. Holding a number of websites might well become a challenge I would think. Again – thanks for the info. Quite interesting – Jason.

admin

🙂 Jason

Mojisola Kupolati (Debbie)

Thank you for the invaluable information about “Assets” and how one can acquire assets for investment purposes. The various options you suggested for acquiring assets are all doable. From your explanation, I now understand that the risk often associated with investing in the stocks may be addressed by not withdrawing stocks when the stock prices drop. Also, I find it very interesting that one can acquire assets with zero cash. I will be exploring the option of creating more quality content on my website.

admin

Thanks Debbie.

osei kwame

Thank you for the educative information you have shared. We all have assets that we are not aware of, once you are able to create an asset without capital means that we all possess some assets.

Your article is very informative and interesting to read too. A lot of people will love this article. Keep it up

admin

Yes we gotta work out assets and liabilities first. RICH DAD POOR DAD taught me that.